|

|

|

|

#76

|

|||

|

|||

|

Sincerely dont see why they couldnt, and will tell you why... open a check account here in the US is as easy as getting a driver license. Try to open an bank account in some european country or in chile for example, they wont let you even to ask for a check account even if you were obama's son and you had bush himself going to the bank you to ask. In many countries to avoid the money laundry a person has to have like 3 years of work in one place, if you are foreign you have to be resident for over 3 or 5 years, then have a good job and who knows what else, real pita.

Here even if you are in vacations you can open a bank account with a couple of hundreds, they will take the money, in other places you just can't because their laws are more strict than here. Based on that big difference, do you think they wont be able to use the system as anybody else? So now, you have a bank account, you move money here and there, you get bitcoins, you buy goods with those bitcoins and then you sell the goods you bought, the result? clean money at the other end. Personally I don't even want to think what will happen the day the bad guys take all their money off the banking system... |

|

#77

|

|||

|

|||

|

A bit cumbersome if you have to launder the high volumes of $ the drug barons have to deal with. However, I have heard of them buying "legitimate" business to try and do this. A while back at least one of the Mexican cartels owned quite a few horse-racing related properties in the US.

|

|

#78

|

|||

|

|||

|

Big money uses the art market for this. Bitcoins is for pikers.

|

|

#79

|

|||

|

|||

|

Not well. Someone as smart as Peter Lynch never invested in anything he did not understand.

http://www.businessinsider.com/repor...rrested-2014-1

__________________

Nothing better than saddle time and raising your heart rate! |

|

#80

|

|||

|

|||

|

i can't fathom how people are taking bitcoins seriously. i mean, come on, putting your "real" money in play by investing in it? consider worst case, the u.s. gov't could at least sell yellowstone nat'l park and bolster the asset side of things.

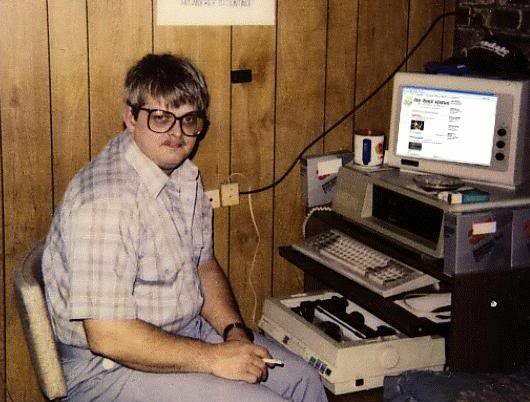

bitcoins have exactly what behind it--this?

|

|

#81

|

|||

|

|||

|

Bitcoins (or something like it) are the future. That future may or may not include "Bitcoins" but I think it's a little shortsighted to dismiss them outright. I remember when Facebook first came on the scene. I didn't like it then and don't like it now, but I was foolish to dismiss it like I did. Not gonna make the same mistake now. There's a lot of 'there' there as regards virtual currency. Things are just getting going.

PS: I don't own any bitcoin nor have I ever, but my personal renaissance is just getting going. |

|

#82

|

|||

|

|||

|

Quote:

http://money.cnn.com/2014/01/27/tech...html?hpt=hp_t3 Unregulated exchange. Why not put you money where you mouth is and invest you life savings. |

|

#83

|

|||

|

|||

|

In one stroke of a pen by various nations, Bitcoins (or other currency outside the control of law & gov't.) can be made illegal. Period.

That's pretty much all one needs to know with respect to anything outside of "real" currency. Quote:

|

|

#84

|

|||

|

|||

|

Not surpised by this at all. More than likely this is just the beginning as other government agencies throw their weight into this is well.

|

|

#85

|

|||

|

|||

|

Quote:

Quote:

|

|

#86

|

|||

|

|||

|

A lot of this can be based on historical information

Some i do not agree with Ray and some I do agree but it is a healty conversation over beer or RED wine

I think we are losing at least 6% annually---- for the CPi does not include energy(oil and by products, food, nor cost of medical. In fact there is movement trying to further change Cpi which is tied to Social Security and other compensations. Changing CPI will hide the real costs. AS MOST PEOPLE HAVE FOUND WITH SALARY increases vs cost of living. Many things are changing but that is life Bitcoin is talked about alot but it will not work across muliple countries. I will bet $$ s on it. With all the bashing, the US$ is the foundation worlwide. ....for at least the next 20 years !!!!!!!!!!!!!!!!!!!!!!!!!! Yep, will bet Red wine and a ride in NAPA  [/B]QUOTE=Ahneida Ride;1463758]Congress has relinquished is fiduciary responsibility to a private corporation. It return, it gets all the funding it needs via a back door method. The private corporation gets to create $ outa thin air and charge interest on nothing. The subsidiaries of the private corporation (commercial banks) can then the practice the Ponzi Scheme of "fractional reserve" knowing that the private corporation is there is bail em out. We the people looses about 6% per year of our purchasing power. This fed reserve dilution tax is the most pernicious tax of all. We now rent out homes, cars and educations from banks. Since this private bank controls our nations money supply, It controls the politicians. ----------------- "The few who understand the system, will either be so interested from it's profits or so dependant on it's favors, that there will be no opposition from that class." — Rothschild Brothers of London, 1863 "Give me control of a nation's money and I care not who makes it's laws" — Mayer Amschel Bauer Rothschild "Whoever controls the volume of money in any country is absolute master of all industry and commerce." — James A. Garfield, President of the United States "I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a monied aristocracy that has set the government at defiance. The issuing power (of money) should be taken away from the banks and restored to the people to whom it properly belongs." — Thomas Jefferson, U.S. President. "History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and it's issuance." — James Madison "People who will not turn a shovel full of dirt on the project (Muscle Shoals Dam) nor contribute a pound of material, will collect more money from the United States than will the People who supply all the material and do all the work. This is the terrible thing about interest ...But here is the point: If the Nation can issue a dollar bond it can issue a dollar bill. The element that makes the bond good makes the bill good also. The difference between the bond and the bill is that the bond lets the money broker collect twice the amount of the bond and an additional 20%. Whereas the currency, the honest sort provided by the Constitution pays nobody but those who contribute in some useful way. It is absurd to say our Country can issue bonds and cannot issue currency. Both are promises to pay, but one fattens the usurer and the other helps the People. If the currency issued by the People were no good, then the bonds would be no good, either. It is a terrible situation when the Government, to insure the National Wealth, must go in debt and submit to ruinous interest charges at the hands of men who control the fictitious value of gold. Interest is the invention of Satan." — THOMAS A. EDISON and finally .... The last President to circumvent the fed, issuing United States Notes ,was the Honorable John Fitzgerald Kennedy.[/QUOTE]

__________________

L-o-n-g bike luster

|

|

#87

|

|||

|

|||

__________________

L-o-n-g bike luster

|

|

#88

|

|||

|

|||

|

Quote:

FOOD AND BEVERAGES (breakfast cereal, milk, coffee, chicken, wine, full service meals, snacks) HOUSING (rent of primary residence, owners' equivalent rent, fuel oil, bedroom furniture) APPAREL (men's shirts and sweaters, women's dresses, jewelry) TRANSPORTATION (new vehicles, airline fares, gasoline, motor vehicle insurance) MEDICAL CARE (prescription drugs and medical supplies, physicians' services, eyeglasses and eye care, hospital services) RECREATION (televisions, toys, pets and pet products, sports equipment, admissions); EDUCATION AND COMMUNICATION (college tuition, postage, telephone services, computer software and accessories); OTHER GOODS AND SERVICES (tobacco and smoking products, haircuts and other personal services, funeral expenses). The inflation you feel is primary driven by high frequency purchases. So if gas at the pump, food prices are increasing (which they are), inflation feels high. However, less frequent purchases, (appliances, housing etc) may be increasing at a much slower rate. Hence the CPI looks low. For most people, rent equivalent, and energy are the two largest parts of the budget. For most of the U.S., housing has depressed the rent equivalent calculations helping to keep CPI low. Chain CPI which is what you are referring to for SS Colas etc is a much nastier animal. Essentially the gov decides people can substitute down, so as prices go up, you will change your spending habits and buy cheaper stuff. Literally they count on your going from Banana Republic to the Gap to Old Navy eventually to goodwill. This is a nasty cycle. See Japan for details. For as much as Paul Krugman gets bashed lately, you need to see his comments on 'Rent Seekers' to really understand what the elites are doing to the economy. There is a turkish saying: If you hold the honey pot, you get to lick your fingers. |

|

#89

|

|||

|

|||

|

IMO, a system (or financial product) outside of the regulated currency-based systems are, and likely always will be, a destabilizing force that a government (or governments) will do their best to shut down. Or at the very least they will make it very difficult to be widely used by everyday citizens for everyday needs.

A decade or so ago i had a very interesting education on hawala by an EM money mgr., and the impact on a sovereign's money supply (and concurrent ability to issue & service its own debt). The numbers then were staggering, and I cannot fathom how large the underground network is today. Looks like Sweden or a Swedish bank is the first to really push to squash it. http://www.bloomberg.com/news/2014-0...ex-trader.html Last edited by 54ny77; 01-28-2014 at 02:27 PM. |

|

#90

|

|||

|

|||

|

As per Marc Andreesen: take all the bitcoin diatribes, go back a few years, substitute the word "internet" for "bitcoin" and you wind up with the same paragraph.

The amount of angst and hand wringing over bitcoin is fascinating. Very few trading assets with a market cap of 10b get so much attention. The thick smelly irony of it all is the douchelords like Dimon sitting on high with "concerns" about fraud. Please. He was one of many complicit in the most destructive bubble/fraud of our lifetime; credit tiering junk mortgages into "AAA" bonds. That little game destroyed the financial lives of millions. Some dude buying pot with bitcoin isn't quite the same thing. Crypto-currencies are fun. I built a mining rig for scrypt based currencies. It's been a fun project. You guys are probably right; big Govs will likely find a way to shut it down or at least make it more inconvenient to use than it's worth. If it all goes poof, I couldn't care less. But it has been a cool learning experience. I like the idea of it, and the idea behind what makes it actually work, is brilliant. |

|

|

|