|

|

|

|

#16

|

|||

|

|||

|

Quote:

Quote:

The ownership structure is a bit complicated for a company of this size, when you look at the Munich Composites part added to the Boyd ownership and then the aluminum wheels manufacturing (Olive Manufacturing Group LLC). Overall, I like what they're doing. The investment, to me, isn't something I would bet my retirement on. Supporting U.S. manufacturing would be the investment and then buying some of their wheels. Maybe as an investor one could convince them to make some rim brake tubulars, beyond their track wheels?? Last edited by 2000m2; 10-30-2024 at 02:10 PM. |

|

#17

|

||||

|

||||

|

QQQ would be a better investment.

__________________

Colnagi Mootsies Sampson HotTubes LiteSpeeds SpeshFat |

|

#18

|

||||

|

||||

|

I am not, but I wish them luck. They make nice wheels and are good to their customers.

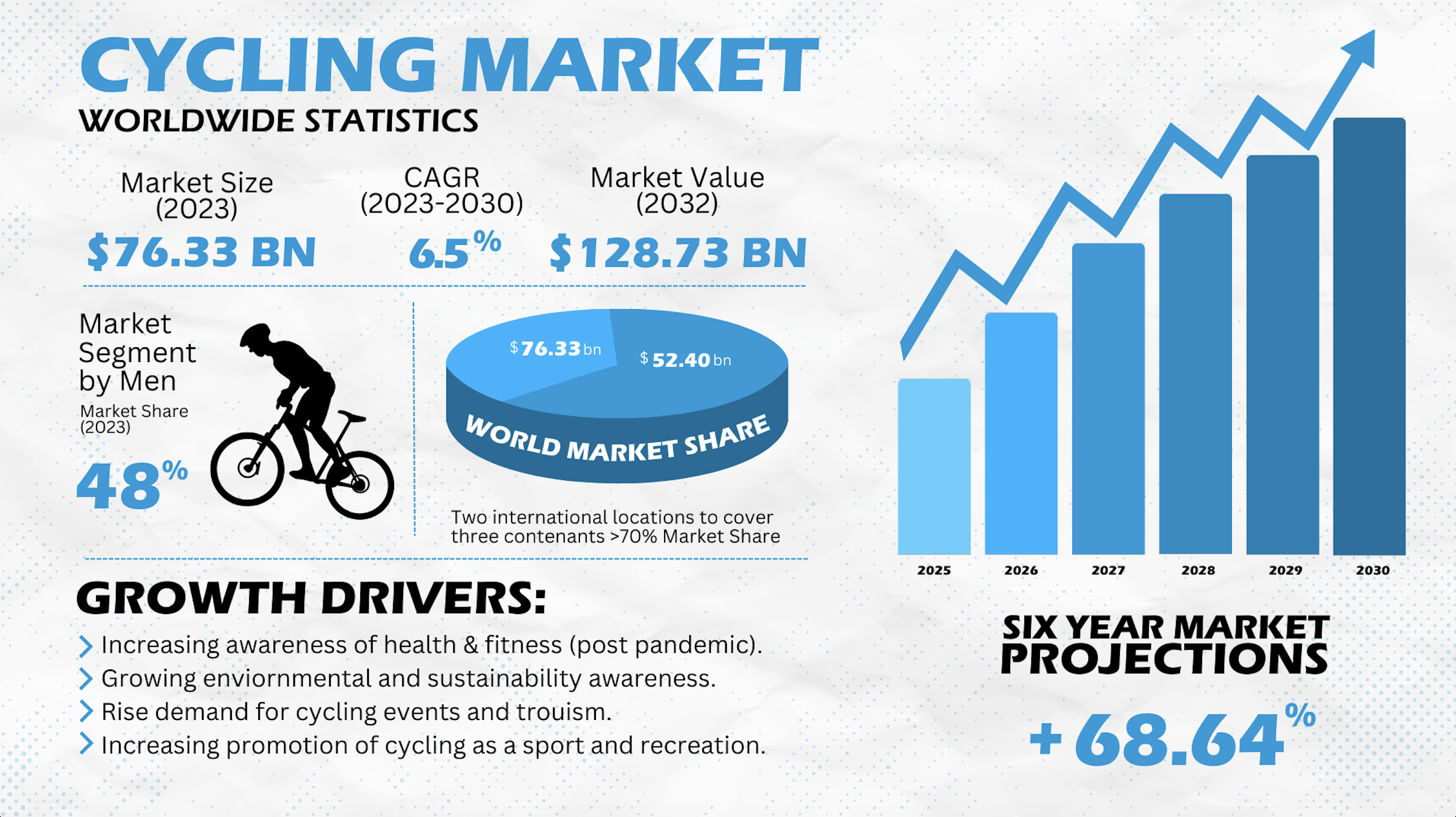

This global market forecast seems a bit rosy.

Last edited by sparky33; 10-30-2024 at 02:19 PM. |

|

#19

|

||||

|

||||

|

I would invest in Kitsbow just to replenish my Icon flannels and liner shorts.

|

|

#20

|

|||

|

|||

|

Quote:

Quote:

And it would appear from pp. 10-11 that quite a bit of the aim of the issuance of common shares in Boyd is for Boyd to purchase preferred A shares in Munich Composite (specifically, the 0.96 M preferred A shares that can be subsequently issued). Boyd's own statement on pg. 38 confirms as much re: effects of the dividend. Who wants to be the schmuck who ponies up money to buy common shares, so that a good portion of it go toward dividend payment? Without both the onerous (pretty much Boyd's own words) dividend payment and what seems to be a move to benefit Boyd itself, I could see value of investing in common shares to gain market share. But what's contained in this disclosure really leads to some unpleasant implications. Way too rich for my blood. If I had money to burn (subjunctive mood emphasized), I might consider loaning them money (say $7500 worth) with a warrant to convert the amount loaned into those sweet Class A shares in Munich Composite. Still risky, but not nearly as much buying common shares in Boyd Cycling. Last edited by echappist; 10-30-2024 at 03:12 PM. |

|

#21

|

||||

|

||||

|

The problem is that offshore made carbon wheels have gotten really, really good.

I'm not really sure what makes them think they are going to get significant penetration into the OEM market when all the OEMs have established connections with offshore makers of goods already. At the very high end, I can see where a customer would pay a premium for a bike outfitted with ENVE or Zipp or Lightweight wheels, but I dont see Boyd brand recognition as significant. As mentioned, I know nothing here. I'm sure they have a plan. Let's see how it pans out.

__________________

http://less-than-epic.blogspot.com/ |

|

#22

|

|||

|

|||

|

Quote:

__________________

Instagram - DannAdore Bicycles |

|

#23

|

|||

|

|||

|

Only if you want to ensure your investment loses value. It would shock me if enough aluminum tubulars, globally, rim and disc, were sold between now and eternity to use up a minimum run of the extrusion.

|

|

#24

|

||||

|

||||

|

I have had great success with my Boyd wheels. Never touched a spoke to true them. Thousands upon thousands of miles.

That said, I won’t be investing. |

|

#25

|

||||

|

||||

|

This. I ran tubulars exclusively for 20 plus years. The problem is there is a lack of tire selection for tubulars and prices have gone through the roof. I've just bought 2 pairs of BTLOS wheels.

|

|

#26

|

||||

|

||||

|

[QUOTEMaybe as an investor one could convince them to make some rim brake tubulars, beyond their track wheels??[/QUOTE]

You don't need to be an investor to do that. They do still make rim brake tubulars. I'm rolling on a few pairs of them and as a Boyd dealer, I have built up several sets for my customers this year. |

|

#27

|

||||

|

||||

|

I can say the same for four sets of Campy Eurus wheels and the first Mavic/Campy wheelset that Oldpotatoe build for me at least 20 years ago!

__________________

Colnagi Mootsies Sampson HotTubes LiteSpeeds SpeshFat |

|

#28

|

|||

|

|||

|

No personal experience with Boyd, company or wheels.

Per the SEC Form C… ~$285k less revenue/sales in most recent year than the previous fiscal year. Net income shown to be (43k) most recent fiscal year and (24k) previous. I’m not a big investor or SEC filing wizard, but If I’m not mistaken, those numbers being in () means loss. Lower sales and larger loss vs previous year - trend is not in the direction I’d want to see. I don’t see how being the ‘only manufacturer of both alloy and carbon rims’ is such a feat. It’s interesting, sure, as is the American-made angle. But are OEMs going to switch from their current suppliers to Boyd? What’s the differentiator or advantage for them to do so? For those reasons, I’m out. |

|

#29

|

|||

|

|||

|

Off the top of my head, the only obvious OEM opportunity would be Time Bicycles, which are also producing out of South Carolina. But I don't know if they do enough volume to substantially improve Boyd's sales. Maybe Lynskey or Litespeed too? But also not clear what's stopping them from tapping that channel now.

__________________

Instagram - DannAdore Bicycles |

|

#30

|

||||

|

||||

|

Running a niche business that’s manufacturing intensive and competing against established offshore brands…tough space to be in. I’d be tempted to make a call to the Waltons, and skip the VC folks and the small investors.

|

|

|

|