|

|

|

|

#2176

|

||||

|

||||

|

NYSE Going to all electronic trading March 23rd.

(No need for traders on the floor anyway. My guess is that it will stay closed after the health crisis is over) |

|

#2177

|

|||

|

|||

|

Loosing your shirt in the Market is for the little people:

https://www.huffpost.com/entry/senat...b6f5b7c5412d6c |

|

#2178

|

|||

|

|||

|

Quote:

|

|

#2179

|

|||

|

|||

|

Quote:

|

|

#2180

|

|||

|

|||

|

Quote:

|

|

#2181

|

|||

|

|||

|

And bought stocks in companies that specialize in telework infrastructure. Scumbags

Burr incidentally voted against the law that barred representatives and senators from engaging in insider trading |

|

#2182

|

||||

|

||||

Quote:

|

|

#2183

|

|||

|

|||

|

Yes, the old adage, Watch what I do, not what I say.

|

|

#2184

|

|||

|

|||

|

Quote:

Investment Grade debt had 35.6 billion in outflows from retail funds this week. It has just been whole sale selling with spreads blowing out in an illiquid market. All of a sudden, you get 5% YTM in <10 Yr ... looks good to me. If you want more risk, just go look at bank sub debt. Better risk reward than stock here FED can't buy corporate paper, but ECB can. When they buy Euro issued debt by US corporations with businesses in Europe, it genreally helps those same corporate dollar spreads here. Last edited by verticaldoug; 03-20-2020 at 12:58 AM. |

|

#2185

|

||||

|

||||

|

Quote:

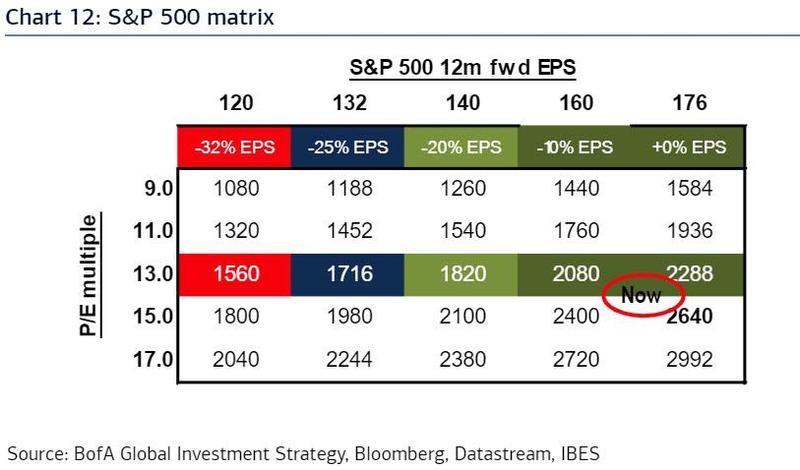

I do think we're in a time with very little slack in business operations. You are seeing all these firms draw down their revolver facilities. I think we're going to find that a number of firms are more fragile than we thought and could see a wave of defaults. Interesting table

__________________

And we have just one world, But we live in different ones |

|

#2186

|

||||

|

||||

|

Quote:

. Last edited by Tony T; 03-20-2020 at 04:57 PM. |

|

#2187

|

||||

|

||||

|

Stocks fall in another day of market turmoil, erasing the “Trump Bump.”

The S&P 500 fell about 4 percent, after rising earlier in the day, as the mood in financial markets grew increasingly dour. It was another sharp turn in a market that has come to be characterized by dizzying changes in direction over the past month as investors have grappled with the barrage of developments. Friday’s drop meant that the Dow Jones industrial average closed below where it stood on the day before Mr. Trump was inaugurated, erasing the so-called “Trump bump” that the president has cited as evidence of the success of his presidency. The S&P 500 isn’t far from that mark as well. Stocks have collapsed about 35 percent in a month, wiping out trillions in value, and their decline on Friday came as the Federal Reserve made yet another move — this time, the backstopping of municipal money market mutual funds — to try to stabilize the economy. Under the plan announced on Friday, the Fed will accept short-term, highly-rated municipal debt as loan collateral in one of its emergency programs. That will give banks an incentive to buy such debt from money market mutual funds, allowing them to offload the securities to come up with cash quickly, and it could keep the funds, popular investments among ordinary people and companies, from crashing as investors cash out. Last edited by Tony T; 03-20-2020 at 04:36 PM. |

|

#2188

|

||||

|

||||

|

NYT: Senate Democrats Block Stimulus Package

The fate of a sweeping government rescue package to prop up an economy devastated by the coronavirus pandemic was in limbo on Sunday after Democrats blocked action in the Senate, objecting to an emerging deal that they said failed to adequately protect workers or impose strict enough restrictions on bailed-out businesses. |

|

#2189

|

|||

|

|||

|

that's a misleading headline if I ever saw one

|

|

#2190

|

||||

|

||||

|

Agree.

FIFY.

__________________

Old... and in the way. |

|

| Tags |

| economy, freemoneyhouse, stonks, vertdoug for fed chair, wealth, yen carry trade |

|

|