|

|

|

|

#811

|

|||

|

|||

|

Wait, I thought NFT was chain lube? Am I on the wrong forum?

|

|

#812

|

|||

|

|||

|

Yes, and I hear all the posts pitching the advantages of cryptocurrencies in Dan Ackroyd’s voice.

|

|

#813

|

|||

|

|||

|

Quote:

What is the use case that bitcoin improves upon existing solutions? Normally in fintech, the technology improves productivity and reduces cost. You can do the same thing as before maybe even better, but cheaper. Bitcoin is the opposite. It is probably the most expensive asset to transact in right now and that includes physical gold. If I recall, the whole point of bitcoin was to be a decentralized network which could not be controlled. I think the reality of bitcoin and crypto in general, is it is heavily centralized and a few large players have huge influence. You can say the samething about Goldman and JP Morgan. But these entities are regulated and do have rules to follow. They may still **** you a little, but crypto will **** you alot. Bitcoin by itself is not a scam, but the ecosystem around cryptocurrencies are. So even if Bitcoin is not the fraud, it's valuation is being decided by fraud. As I have said before, Stablecoins are just another variation of free-banking in the US pre-Civil war when any bank could issue scrip supposedly backed by assets. Most, not all, of these were frauds. Some very basic regulation is very necessary. Something as simple as having truly segregated client accounts, front running, trading against the client, wash trades, bucket shops and even something as simple as a AUDIT is there to keep the insiders from taking advantage and ripping off outsiders. Tether has no AUDIT. They keep on coming up with excuses why they cannot audit. If that isn't a red flag, I don't know what is. All these stablecoins and defi are a form of shadow banking which leads to huge amounts of leverage. If I borrow a million dollars, I am not a millionaire. That is a bit of what crypto is like. We saw how Archegos used massive leverage last year, lied to counterparties and blew up in stocks. Bill Hwang who was running archegos will go to jail. His stocks collapsed 90%. How much leverage is in crypto via stablecoins and other scams? No one knows. People in finance are always trying to take the money and run. Crypto is no difference. You say it is a technology, but the technology is controlled by people and human behavior has not changed. Regulation is a necessary evil. The question is how much regulation, no regulation will always be a unmitigated disaster. It always has in financial markets. So just being 'NEW' doesn't mean anything for Bitcoin. If bitcoin is a new application in finance, it will need to have many of the same regulations as current financial markets. Technology can change, but human nature doesn't. See people and social media for details. Last edited by verticaldoug; 06-15-2022 at 04:19 AM. |

|

#814

|

|||

|

|||

|

Quote:

|

|

#815

|

|||

|

|||

|

You just have to love this cryto stuff:

A story in the NYT about Tether: https://www.nytimes.com/2022/06/17/t...smid=url-share Call me old-fashioned, but this is not how I think one builds a stable economy. Quote:

|

|

#816

|

||||

|

||||

|

I don' t know much about Bitcoin (or other block chain pseudo currencies)--but I have been enjoying this website--a young (woman) programmer named Molly White, who posts links and brief discussions to the various debacles and scams. I think she knows the biz (and has written more serious pieces elsewhere):

https://web3isgoinggreat.com/ |

|

#817

|

||||

|

||||

|

Bitcoin dips below 18k

“SAN FRANCISCO — The price of Bitcoin fell below $20,000 for the first time since November 2020 on Saturday, amid a broader market meltdown driven by rising interest rates, inflation and economic uncertainty spurred by the war in Ukraine.More: https://www.nytimes.com/2022/06/18/t...oin-20000.html Last edited by Tony T; 06-18-2022 at 03:17 PM. |

|

#818

|

||||

|

||||

|

Getting spicy.

Did MicroStrategy dump? They had the most by a lot iirc, followed by Tesla. |

|

#819

|

|||

|

|||

|

#820

|

||||

|

||||

|

#821

|

||||

|

||||

|

Great opportunity to get into crypto investment. And if you are down it's also a good buying opportunity to make gains on the way up to where you were.

What I recently learned is that traditionally the bottom has been found when inflation reaches it's peak. So the bottom of BTC may not yet be here. I'm waiting it out. You can't go wrong buying in at 20k though. You will probably double that investment in year, possibly sooner. But I still think BTC could hit 15k or lower. General rules of crypto apply, do NOT ever invest with money you need. If you can't afford cloths then you don't belong in the crypto space. But if you can afford to take a risk the reward potential are there. |

|

#822

|

||||

|

||||

|

Quote:

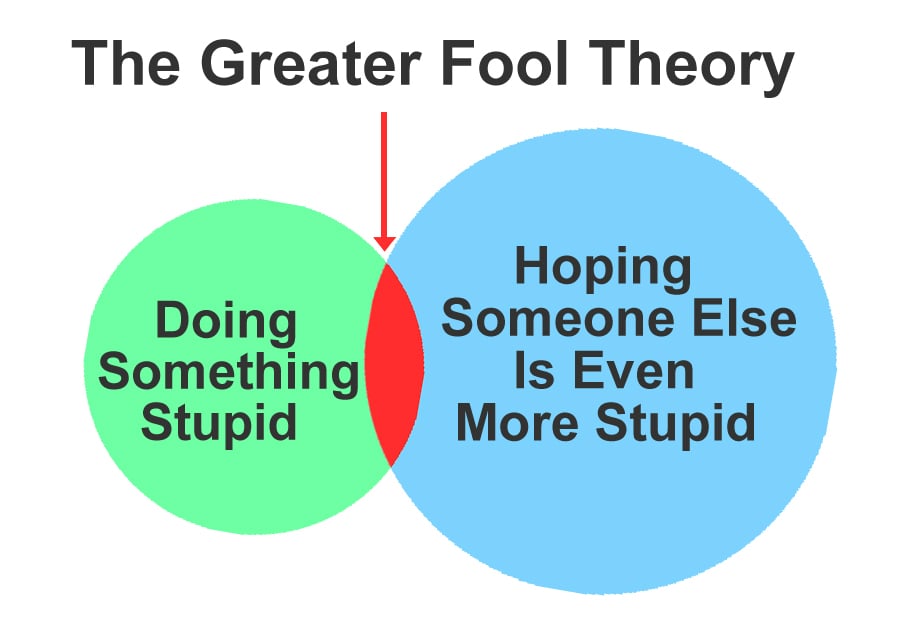

^ Definitely someone who advised buying Worldcom stock back in July 2000. Buying the dip can be a smart approach to specific stock buying if the stock has reason to be worth more than it currently is. Pure speculation is not a valid investment strategy. Pure speculation may pay off, but that doesnt mean its smart. As for your general rule of crypto investing, that is no different from any other investing. You shouldnt invest with money you need. That goes for Apple, Ford, BTC, or anything else. |

|

#823

|

|||

|

|||

|

Quote:

Buy when there's blood in the streets (everyone crying about it being over, and told ya soers suddenly come out of the woodwork en masse acting like they knew all along). Usual response to the nay sayers: "then short it" |

|

#824

|

|||

|

|||

|

Quote:

Quote:

|

|

#825

|

|||

|

|||

|

Quote:

|

|

|

|